U.S. universities could face a significant loss in tuition revenue as new federal student loan caps for graduate students threaten to reduce enrolment, according to recent research. The changes, part of President Donald Trump’s broader overhaul of student lending, are set to take effect in July and could reshape access to graduate education.

Researchers warn that the policy may leave tens of thousands of students unable to finance advanced degrees, particularly in fields with high tuition costs. That, in turn, could reduce tuition income at a time when universities are already under financial strain.

An analysis by American University and the Federal Reserve Bank of Philadelphia estimates that up to $10bn in existing graduate student aid would exceed the new borrowing limits. More than 160,000 students are expected to face funding gaps, with some unable to secure alternative financing. If students abandon or delay their studies, institutions risk losing not just loan-funded tuition but entire enrolments.

The new loan limits arrive as universities contend with multiple pressures. Federal grant funding has been cut, legal challenges against higher education institutions have intensified, and tighter visa policies have reduced international student numbers. A recent survey of colleges found a 17 per cent drop in new foreign student enrolment, further tightening budgets.

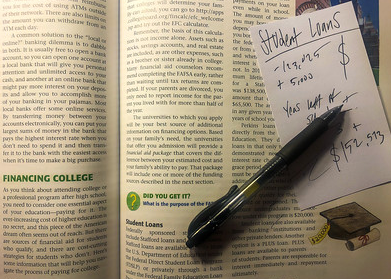

Under the administration’s “One Big Beautiful Bill” act, graduate students enrolled in programmes classified as professional — such as law and medicine — will be capped at $50,000 per year in federal loans. Other graduate programmes, including nursing and business, will be limited to $20,500 annually.

What’s changing — and why it matters

The reforms are designed to curb the growth of federal student debt, which has risen sharply over the past two decades. But education researchers warn of unintended consequences:

- Lower borrowing caps may price students out of graduate programmes with high tuition

- Private loans, often the alternative, typically carry higher interest rates and stricter credit requirements

- Lower-income students may be disproportionately affected due to limited access to private financing

- Universities could lose tuition revenue if enrolment falls rather than shifts to private lending

The Department of Education argues that the new limits will help restrain tuition inflation and reduce long-term debt burdens. Officials say most students in certain fields, such as nursing, already borrow below the new thresholds, and undergraduate programmes are not affected by the caps.

However, higher education experts caution that the policy may discourage graduate study altogether, especially in fields where earnings vary widely. Some argue that a more targeted approach — linking loan limits to expected income by profession — would better balance access with debt control.

Institutions offering degrees no longer classified as professional have raised particular concerns. Business and nursing schools are lobbying to have their programmes reclassified to qualify for higher borrowing limits, warning that reduced access could undermine workforce development.

Industry groups also fear broader labour market effects. Nursing associations have warned that restricting graduate education could worsen staffing shortages and limit access to patient care, while business schools argue that reduced enrolment could weaken long-term economic competitiveness.

The Education Department has rejected claims that the policy will harm access, accusing critics of overstating the risks. Officials maintain that the changes are necessary to rein in federal exposure and encourage institutions to control costs.

As the July implementation date approaches, universities, students, and lenders are bracing for a period of adjustment. Whether the new loan caps succeed in reducing debt without shrinking graduate education remains an open question — one with high stakes for both students and institutions.