Dividend growth stocks, companies that consistently raise payouts to shareholders, are attracting interest beyond traditional income-oriented investors, according to recent analysis of dividend-focused strategies. Rather than serving solely as cash-flow vehicles, these equities now play a broader role in diversified portfolios, blending defensive traits with long-term return potential.

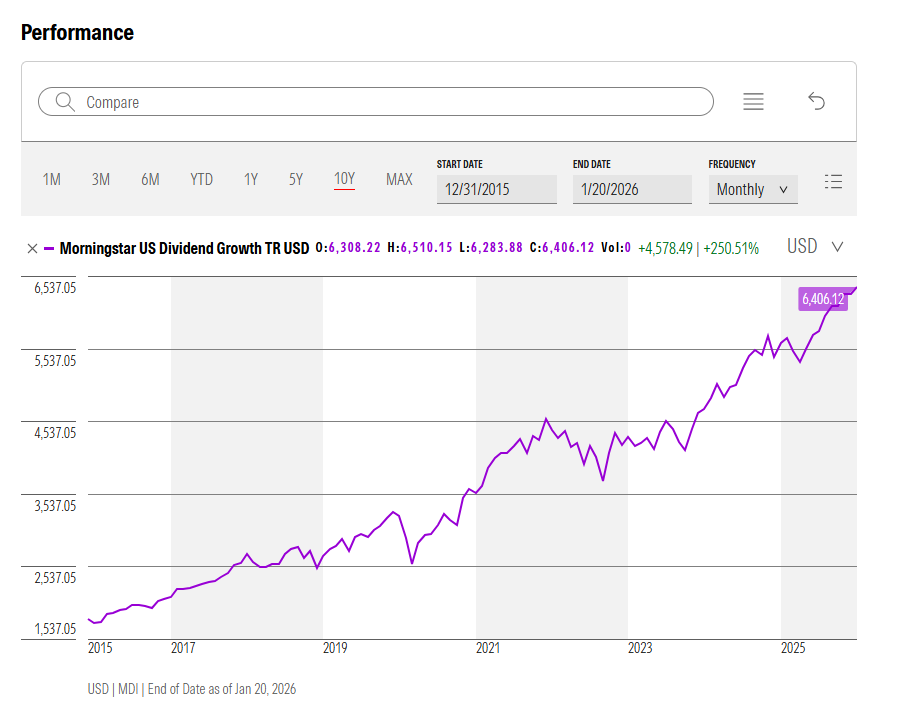

At the heart of the strategy is the Morningstar US Dividend Growth Index, which tracks companies with at least five years of rising dividends. While historically associated with stability and reliable income, this index sits on the value side of the market rather than mirroring classic growth-oriented equity strategies.

Dividend growth strategies tend to include companies with established cash flows and disciplined capital allocation. These attributes can make such stocks less volatile than the broader market during downturns, an aspect that appeals to investors with a lower risk tolerance or longer time horizons.

However, dividend growth stocks have not always been top performers relative to the broader U.S. equity market. Their underweight exposure to major technology and high-growth names, many of which do not pay dividends or have recently initiated payouts, has contributed to periods of relative underperformance. That said, this composition also helps explain why dividend growers may falter when growth-oriented stocks dominate but outperform when markets turn defensive.

Key facts about dividend growth stocks

- Not just income: Dividend growth stocks offer exposure to companies with increasing payouts, but total return can come from share price appreciation as well as rising dividends.

- Defensive traits: These stocks often exhibit lower volatility than the broader market, helping cushion portfolios during sell-offs or periods of uncertainty.

- Value orientation: Dividend growth indexes typically have a heavier value bias than growth benchmarks, with less concentration in high-flying tech names.

Analysts note that while dividend growth stocks may underperform in strong bull markets driven by a narrow group of large, non-dividend tech stocks, they can offer steadier performance over full market cycles. For example, during periods of stress or when rotating into defensive assets, dividend growers may hold up better due to their cash flows and established business models.

Investors should distinguish between high-yield dividend strategies, which prioritize current income, and dividend growth approaches, which emphasize regular increases in payouts over time. Dividend growth approaches often appeal to investors who value both income and quality characteristics, such as strong balance sheets and consistent earnings, rather than solely seeking a high current yield.

Dividend growth investing also carries risks. Because tech and growth stocks have increasingly dominated broader market performance, dividend growth indexes can lag during technology-led rallies. Yet some of today’s dividend growers include rising payouts from sectors like financials and healthcare, as well as select technology names that have expanded their distributions.

For financial and investment readers, dividend growth strategies represent more than a source of periodic cash; they are a tool for balancing return and risk in diversified portfolios. Understanding how these stocks behave relative to the broader equity market can help investors choose allocations aligned with their goals, whether they prioritize income, stability, or long-term growth.